Track Record

Storelocal, and now Tenant, have almost eerily predicted the trajectory of consolidation, data ownership, and data control in the self storage industry.1 We warned that if you don’t control and benefit from your data, someone else will. They have. We said the REITs’ advantage was data, not market share. The gap between the largest operators and the rest of us widened, as they contained and utilized their data while we gave our vendors full access and utilization of our data. We said the storage industry will consolidate rapidly. Look at SpareFoot, Clutter, and Janus M&A. We said storage technology is an investment, not an expense, and our failure to embrace this leaves us vulnerable to supply chain disruption. Outside funding has flooded the market to the tune of roughly two billion dollars. That’s billion with a “b.”

We ceded our data for leads and sub-par products. Short-sighted. Vendors either didn’t know how to capitalize on our data or couldn’t as standalone companies, subduing their valuations. Short-sighted. So, outside funding came in to scoop up complimentary vendors and finally capitalize on the data we gave them for free. The opposite of short-sighted.

The sad part is that all of this was predicted. We could have changed the trajectory. Instead we were complicit.

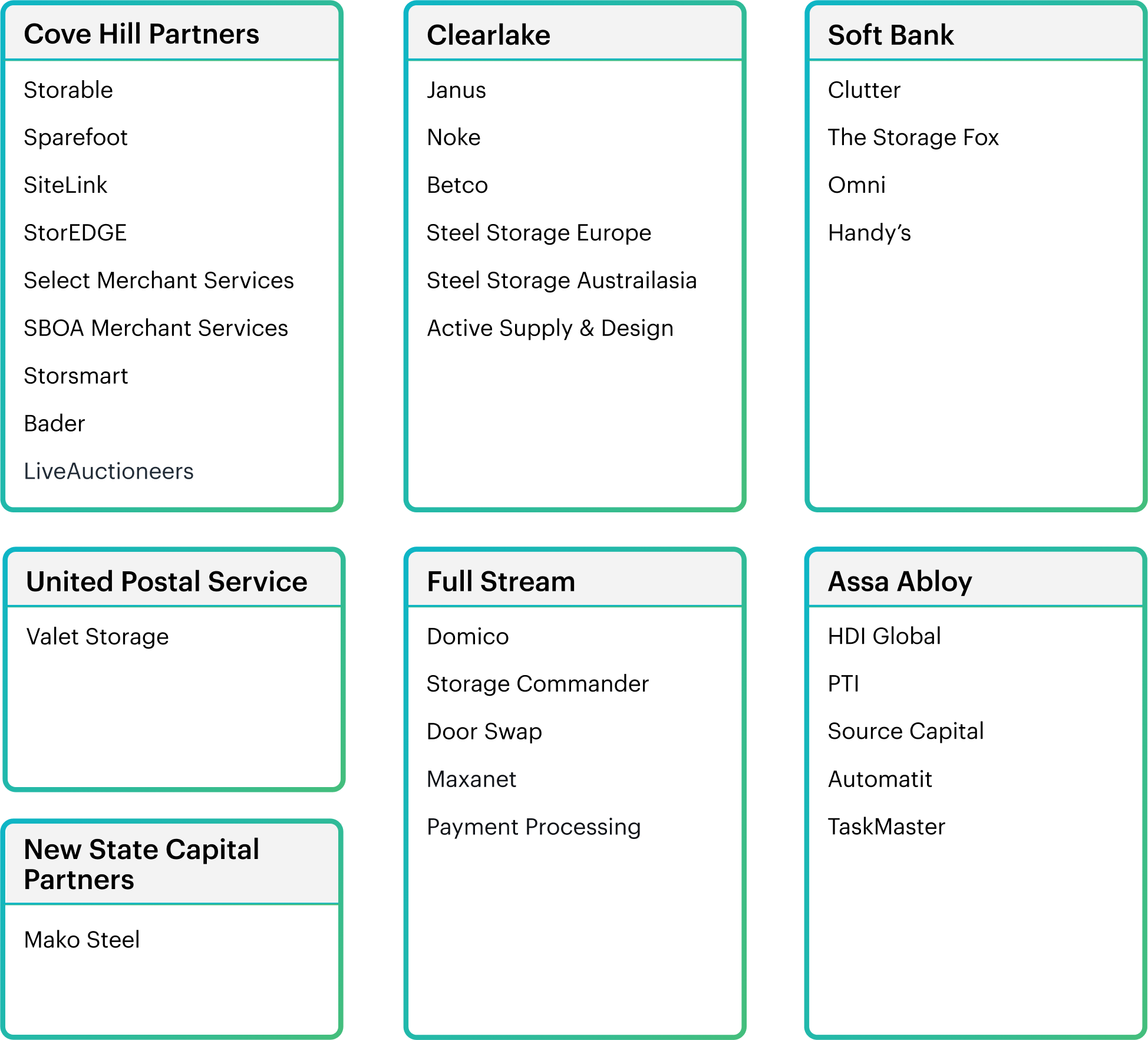

While the industry discussed data, private equity-backed SpareFoot amassed the trifecta: lead gen, a web platform, and property management software. Did we mention payment processing and insurance? Smart…they’ll fund further growth AND round out their data sets. Sprinkle a little access control on top. And they are just getting started. Data concerns have reached a new high water mark.

Now what? It’s going to take us 13 pages to unpack that, but the short answer is we don’t need to be complicit. We don’t need to grant vendors access to all of our data. Cash is no longer king – data is. Data is the new oil. Data is the new gold. Capitalize on it! Protect it! Don’t give it away! Don’t let others capitalize on your data at your expense!

The Kittens are Pythons

Is the situation really as dire as we portray? SpareFoot’s bundled services offer smaller owners the opportunity to run their businesses a little more like the Big Five…more sophisticated and more efficient. Is this rainbows and kittens for the industry or tsunamis and pythons?

Do SpareFoot’s bundled services sound great? Feeling like you can finally compete? Maybe not.2 There’s no such thing as a free lunch. If it seems too good to be true, it probably is.

The problem is two-fold.

First, the quality of products and services. The SpareFoot solution is more consolidation than innovation. When you gobble up existing products and smash them together, you have to improve and integrate these products. That’s HARD. That’s old-school consolidation. Isn’t innovation preferable? Start from scratch and build ideal products that are inherently integrated – streamlined rather than clunky. Ready for the next big thing. Ready to adapt and evolve as technology changes. Designed to serve the client.

Second, and critically….access to and control over DATA. If SpareFoot’s strength was alarming in 2015, it’s now Stephen King scary.3 Five years ago, facility owners worried Sparefoot’s web dominance necessitated use of the directory. Owners fed the monster and the monster grew. Now, owners feel they must keep feeding the monster just to avoid being swallowed whole. And so the monster gets bigger and stronger. SpareFoot had web dominance and data, but now the SpareFoot behemoth (branded Storable) has web dominance and LOADS of data. Loads of data from complementary channels. LAYERS of data.

The funny thing about data is that its value is a product of its quantity and variety. Loads & layers. Is Storable positioning to CONTROL the storage industry’s data? Their market penetration should not proceed unchecked. Let’s not be complicit.

The End at the Beginning: Cornering the Market on Data

We’ll cut to the chase, in true Tenant style. Data is valuable. You’ve gotten that message loud and clear from us for years. Loads & Layers. What else makes data even more valuable? Cornering the market on data. Using it as a competitive advantage. Simply put, data is most valuable when you have a lot of data on top of data, and no one else does.

Data is akin(4) to a zero sum game. Capitalize on your data to the fullest extent AND prevent others from doing so. The latter is the key take-away. Currently, each of your vendors access ALL of your data. We’re complicit. Our defensive team is warming the bench while the other team scores a touchdown unchallenged. It’s time to put an end to that racket. Ready for some great news? We already have the technology to control data outflows.

Your data is a valuable asset. Would you keep your facility open for anyone to enter 24/7 and keep all the storage units open for anyone to use in whatever manner they desire?

You own your data – act like it.

Then, once you restrict your outflows to only the necessary data, consider whether the product or service you receive is at least as valuable to you as your data is to them AND strategically, which competitor you want to bolster by way of your data. Don’t feed the monster.

If tech companies with a lot of money, market share, and DATA are able to amass even more data, you will get further and further behind. You can stop giving data away at any point. But we might not be able to take back market share, scale, or web dominance at a certain point. It will get harder and harder to remain independent while remaining in the black. We need to play offense and defense. Luckily,(5) options already exist.

The Data Race in Other Industries

Let’s be honest, self storage has traditionally lagged behind other industries in terms of sophistication and complexity. That’s one of the reasons we all thought this would be a profitable business to get into – operating costs were low. So, let’s examine what’s going on with the race for data dominance outside of self storage. We’ll see what insights we can glean and apply to self storage…to increase our profits, protect our future, and better the industry as a whole.

With that in mind, let’s turn to 8 individual case studies. Each will add a thought-provoking nuance to the idea that it’s a race to corner the market on data, where the initial data hoarders win and everybody else loses.

CVS-Aetna

Let’s start with an easy one. Tenant previously pointed to the CVS-Aetna deal to illuminate the massive value of data. Now, after their huge outlay, CVS is under pressure to justify the acquisition. How did they? By pointing out the advantage of having data their competitors don’t have: “The breadth and depth of consumer data we have access to is unmatched.” The CVS CEO even went further, point out that this unparalleled LAYERED data is “going to be the driving force for change in our health care system.”(6) Bottom line: CVS purchased Aetna to corner the market on data in their sector. This will allow them to outperform their competitors as they base nearly every business decision on facts rather

than intuition.

Gleanable nuance #1: Cornering the market on lots of data, from multiple sources, is a competitive advantage AND transforms industries. 😳 Um…this is a little bit alarming because Storable already secured this competitive advantage. So how will the self storage industry be transformed? Is it rainbows and kittens or tsunamis and pythons? Keep reading.

Amazon

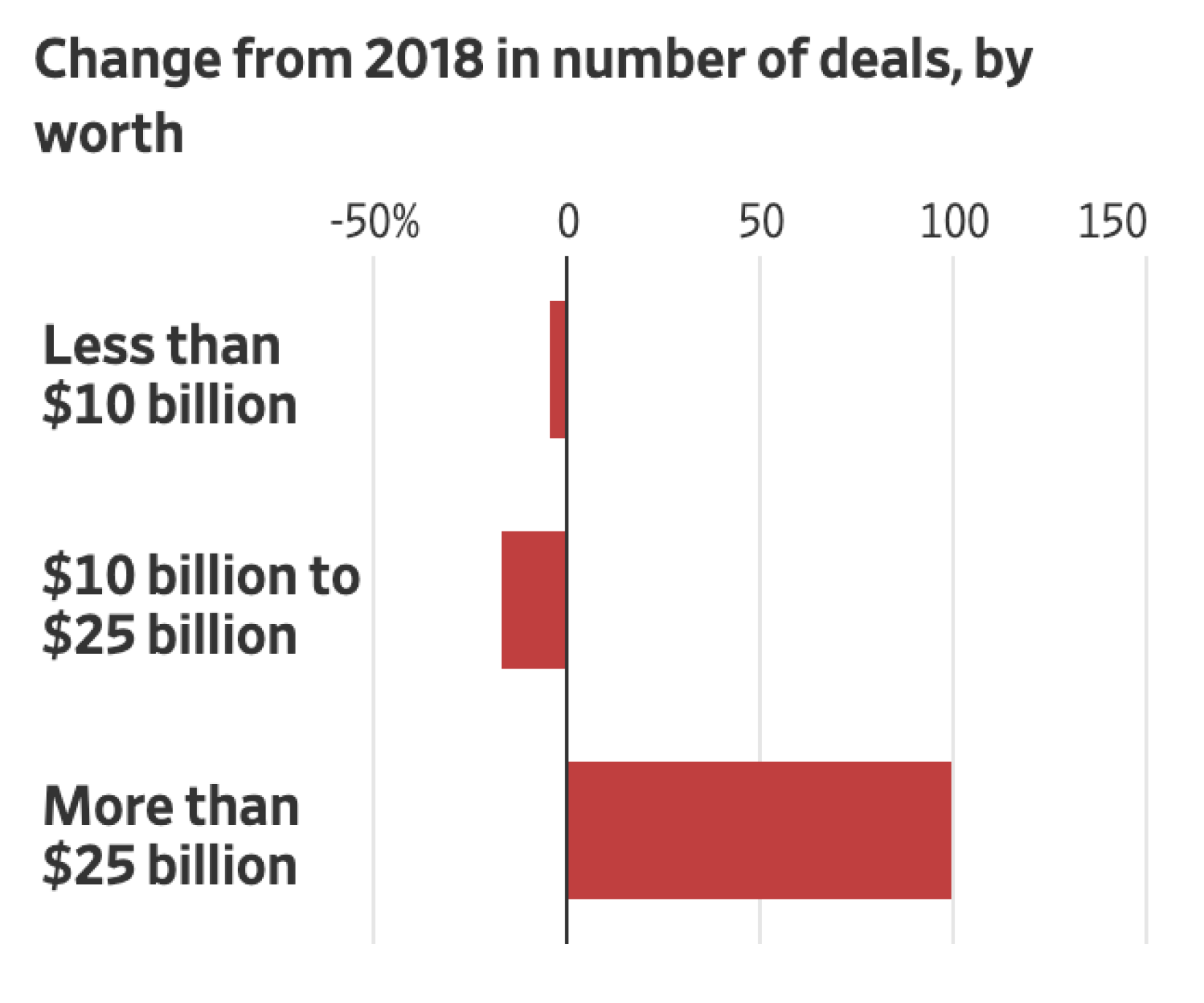

Now a fun one. Did you know that Amazon “struck more than $20 billion worth of acquisitions and investments since the start of 2017, more than its deal volume in all of the previous 23 years in the online retailer’s history”(7)? Why did they spend more in 1 year than in the previous 23 years combined?!! Impact of data on big business? “Many business mergers are pursued with an eye toward cutting costs by combining jobs and functions. But Amazon acquisitions often retain considerable autonomy, with the founders or CEOs staying on and operating from their original headquarters. The deals are designed to build out certain areas and harness new data.”(8) You might even say, mergers and acquisitions TO harness new data.

This calls for another bulging eye emoji. 😳 Sound familiar?!! SpareFoot rolled-up StorEDGE, SiteLink, and Select Merchant Services into the “Storable” brand, with the intent to keep the entities largely autonomous. Why? Consolidation’s aim is no longer economies of scale or streamlining operations. Consolidation’s about data.

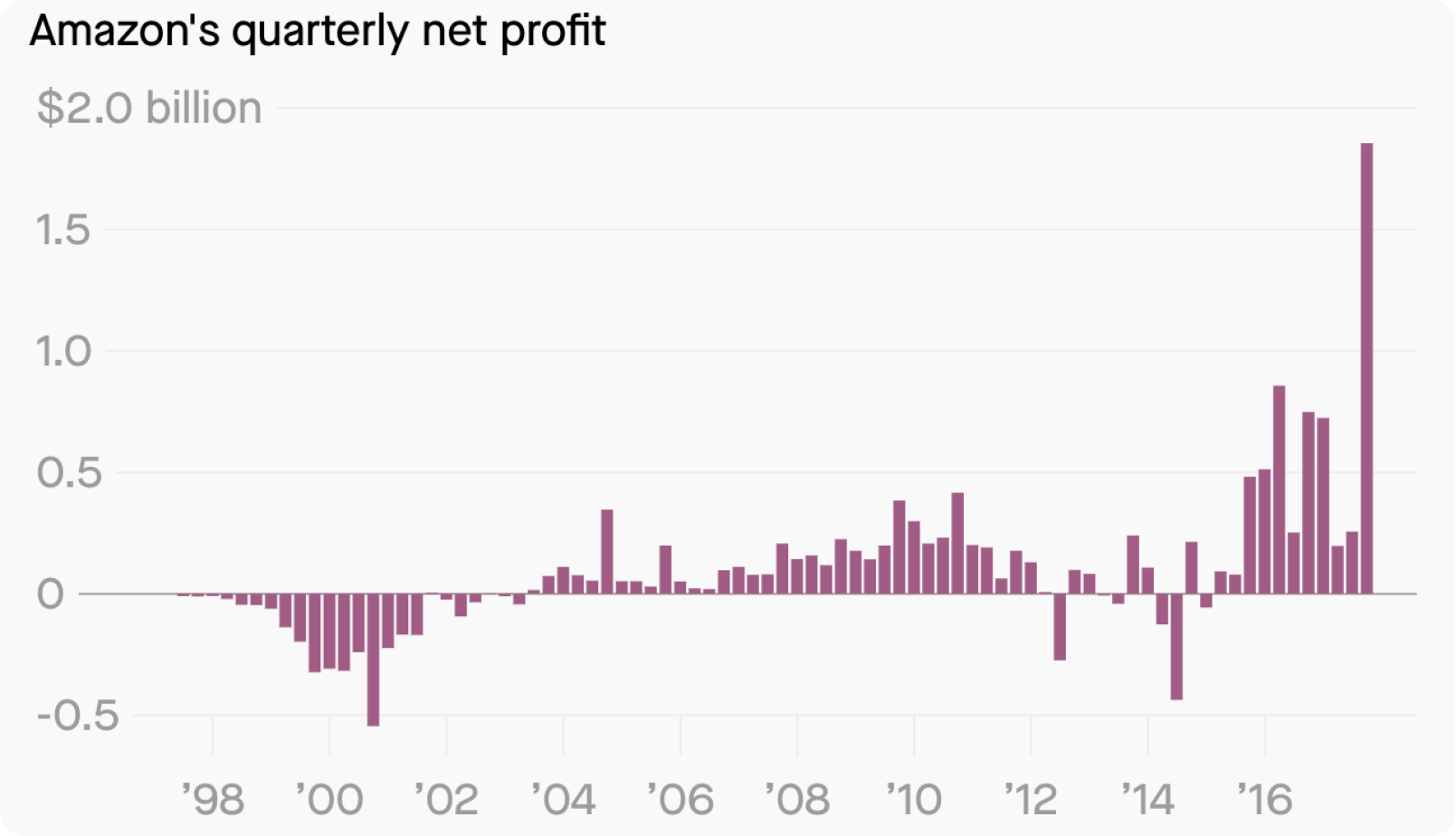

“Industry disruptors strategically forgo short term profits to garner market share.” Well said Travis Morrow. Uber lost $5 billion in a single quarter.(9) Look at how long it took for Amazon to move beyond losses or slim profits.(10)

Even when Amazon’s profits were rising in 2015, they only had “$596 million in profit on $107 billion in revenue—a profit margin of 0.56%.”(11) Think about that. Bonkers right?! That’s a lot of risk and effort for a slim return. Would you put $106.4 BILLION on the line for a profit margin of ½ a percent??? Amazon was, and is, playing the long game. They are playing according to the rules of this brave new world, where it’s all about cornering the market on data.

It’s a zero sum game and the first to market wins. It’s no longer the big eat the small. It’s the fast eat the slow.(12)

As Jevon Global notes in their white paper "Valuation for Early-Stage Technology Companies,“ in 1994 the market valued Wal-Mart at a price to earnings multiple of around 27x….For (2015) Amazon was valued at around 400x to 500x earnings. "The valuation patterns of today are very different from those of the past.”(13) Understatement of the new decade. The data certainly supports this claim (pun intended).

These high valuations then allow them to raise even more money which allows them to consolidate further. Where does it end? Forget the disappearing middle class, what about the disappearing middle sector of the economy. And by middle we mean the middle 80%-ish of businesses. Will it eventually be FAANG and mom & pops? Again, we’re being a bit dramatic, but the trend is clear. Look at the rise of mega-mergers in 2019. Again, bonkers. Scary even? Let’s drive this home. “The top 5 tech firms have made more than 400 acquisitions over the last decade.”(14)

Consolidation is now exponential, and self-perpetuating, especially amongst the biggest players in a sector. Greater consolidation will lead to even more consolidation. The big will get bigger given the value of data and the incremental increase in data’s value as its volume and variety grows. A company gets exponentially more valuable & powerful as their data troves grow. As industry players consolidate data, it becomes exponentially harder for new competitors to enter the market. Consolidation for data is simultaneously offensive and defensive.

Is anyone else thinking about Storable right now? Another interesting wrinkle to the parallel between Amazon and Storable…Amazon’s expansion is largely funded by their website services, which is tangential to their core business. In 2019 Q3, operating income from their web services was 71% of Amazon’s operating profits.(15) Whoever proposed branching into that sector needs a raise stat. Storable’s payment processing and tenant insurance offerings will similarly fund their further expansion. Chuck should get a raise too.(16)

Gleanable nuance #2: The motivation behind M&As has changed. Consolidation was about cutting costs and increasing revenue. Now, it’s often about data….more data & more data variety (those layers we keep talking about). Not only layers, but exclusive layered data.

Data’s value decreases if your competitors have the same data. Data’s value exponentially increases if you have exclusive access amongst your competitors. If a company M&As their way through a sector, they gain layers of data and that data has a gargantuan advantage once they consume all their data-rich competitors. Game changer. More like game over. So….let’s prevent this from happening in self storage. Don’t let a behemoth corner the market on data.

Note the emphasis on competitors. The concern isn’t Storable having your data…their advantage lies in having data their competitors don’t have. With a larger share of the market, and their presence in multiple sectors, they have a data advantage over their competitors in each sector (PMS, lead gen, web, payment processing, insurance, access control). With the most data and the most layers of data, their competitive advantage just sky rocketed.

Apple

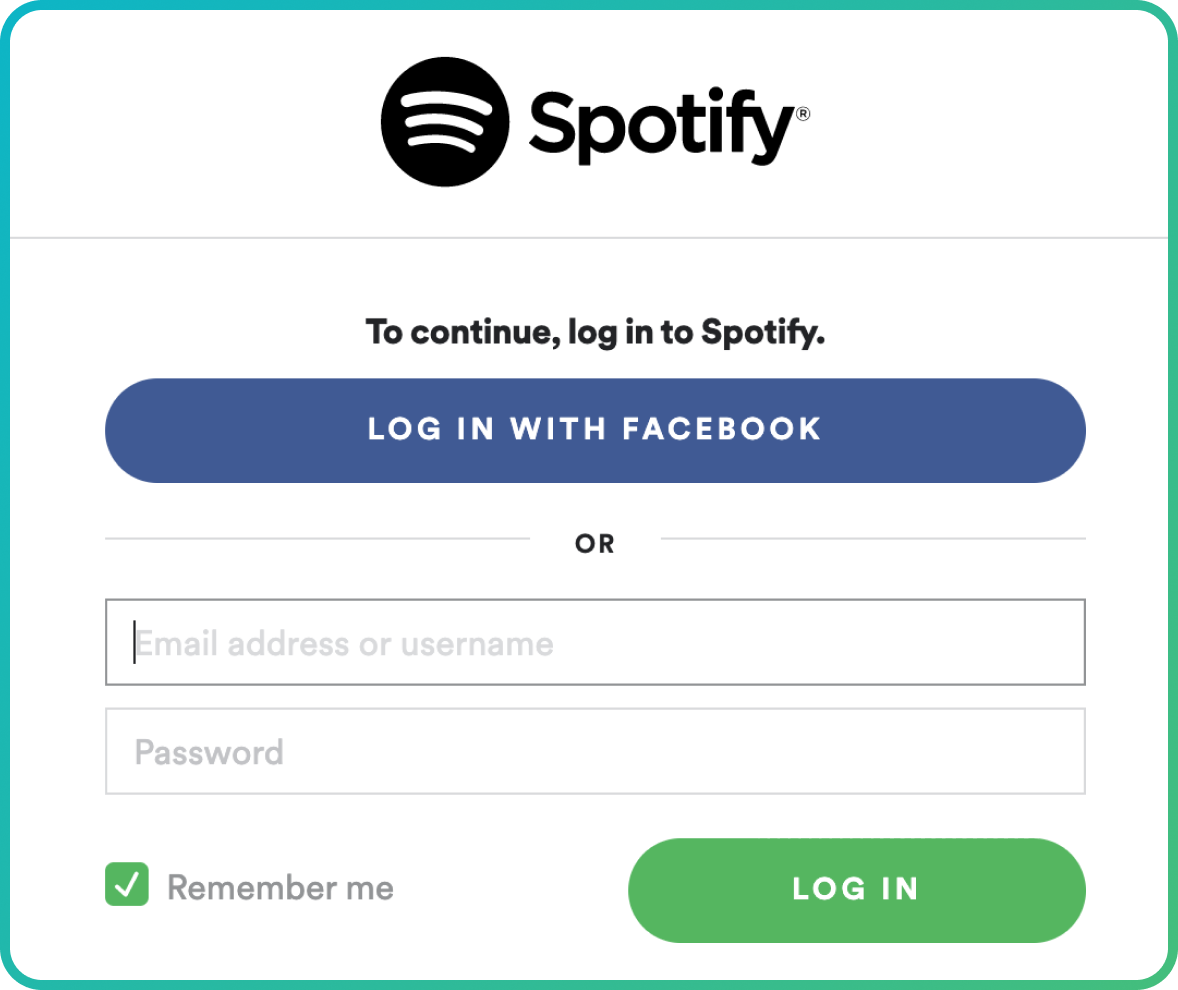

You know when you want to create an account on an app or website and you have the option to do so through your Facebook account? Then you’ve probably noticed a little disclaimer about your Facebook data that will be shared in exchange for this convenience?

Well now apps through Apple’s app store will have an anonymous login option, i.e. the app won’t get any data for this login convenience. You know, because Apple is the champion of privacy and whatnot. 🙄 “The feature…could disrupt the ecosystem that has evolved to support a de facto database of market research on consumers.”(17) This is especially true since about 2/3 of applications are purchased through Apple’s App Store. Apple states that their “sign in with Apple feature” was built “to give users peace of mind about their privacy,”(18) but isn’t it also in Apple’s interest to limit other companies’ access to data? Apple’s feature safeguard’s their market cap and protects consumers. Nifty. It also erodes this touch point between apps and Facebook.

Gleanable nuance #3: With a spotlight on data and privacy concerns, the tide is turning, but is that really a good thing? Will privacy advocacy consolidate data into fewer and fewer hands? That largely depends on who’s gaining a larger share of the data. With Apple’s latest move, Apple protects Apple at the expense of big tech players providing the easy login feature and the apps that would otherwise be receiving data from said players. It’s a defensive move with a nice PR cherry on top. Apple doesn’t gain data, but it blocks others from receiving data. Zero “sum-esque” game. If someone gains, it’s at someone else’s expense. If you prevent someone’s gain, then you win in the sense that you prevented your loss. It’s relative. It’s about relative access to data amongst competitors.

Salesforce

Mid-2019, Salesforce acquired data-analytics platform Tableau at a valuation north of $15 billion (that’s billion with a “b”), making it Salesforce’s “largest-ever acquisition…(despite) many pricey acquisitions in recent years.”(19) The stated goal is to enable customers to “unlock even greater value from their data to drive smarter business decisions.”(20)

Just how important is data, and how valuable are the tools to analyze and utilize data? The world’s #1 CRM paid a 42% premium over Tableau’s closing share price. It was the 4th largest technology deal in the world in 2019 (trailing only fin-tech deals). The biggest tech giants are making similar plays, such as Google acquiring Looker for $2.6B to “mine large caches of data for insights.” (21)

Gleanable insight #4: Data’s competitive advantage lies both in exclusive access to, or control of, data or making use of data in ways others don’t. The more valuable the data (the greater quantity and the more layers) the harder it is to analyze. It’s hard to track a lot of data, then get it all in one place, organize it, analyze it, and then act on it. HARD. Salesforce recognized this and bought Tableau because it will help the CRM’s customers analyze and act on their data. Position yourself to take full advantage of the data you have access to (hint: this is going to take someone pretty damn smart). And keep a keen eye on industry players that have the money and brain trust to fully exploit the value of their data.

Square

Square, the favorite POS and credit card processing tool for millions of small businesses, was recently in the news for sending millions of digital receipts to the wrong people. Think about all the data Square has! Interestingly, they don’t sell “underlying” purchase data or contact details.

“With access to years of data on the purchase activity of hundreds of millions of unique credit and debit cards across millions of small businesses, Square has a window into spending patterns that few other tech companies can match. By supplementing that data with contact details that shoppers provide to Square for the purpose of getting digital receipts, the company is able to assemble expansive profiles of consumer behavior that it can use to run marketing and loyalty programs for its small-business customers.”(22)

Data on top of data.

Square has unique insight into spending patterns at small businesses, combined with shopper’s contact details – yet they don’t sell this valuable data – because they champion consumer privacy and want to protect their customers’ privacy at all costs? Probably not. More likely, it’s because there’s more value in cornering the market on this data than there is in selling it. Like other forward-thinking companies, they are playing the long game. They could sell data for an extended period, but then they’d lose their competitive advantage. If Square maintains exclusive access to their customers’ data, they can target their customers’ customers better than anyone else can. They ensure their dominance in the space and continually raise the barriers to entry for a competitor as they continue to get further and further ahead in the data game. Zero “sum-ish” game. If someone moves ahead everyone else falls further behind.

Gleanable insight #5: Data can be sold for a pretty penny, but to put it into real estate terminology, data’s highest and best use is in securing market dominance. Data as a competitive advantage. With layers of data that no one else has, you can work smarter than your competition. Run leaner. Generate more revenue more efficiently. Know the best place to spend each dollar. Make each dollar go farther. Foresee trends…practically predict the future. You know when to cut your losses and when to double down. With enough of the right kinds of data you can literally do everything better. And, if you’re the one with this advantage, then your competition is basically playing pin the tail on the donkey. Find out who you are allowing to access your data. As much as possible, limit others access to your data. Be very, very selfish with your data. You’ll protect your ability to use your data as a competitive advantage, and you’ll prevent others from using your data as their competitive advantage, likely at your expense (in some form or another).

Foursquare

Foursquare, which sells its users’ location data, purchased its smaller rival Placed mid-2019. The social media app that tracks location had 25M monthly active users while Placed had 6M.(23)

Was this an offensive move to increase data by 20%? Or a defensive move to corner the market on location data? With data as a competitive advantage, not only did they get rid of a competitor, but they made it that much harder for a new competitor to enter the space.Foursquare portrayed the deal as a way to improve their product offering, and we don’t doubt that, but cornering the market on data was likely the primary motive behind the deal.(24)

Gleanable nuance #6: Question the motivation underlying M&A. Who issues a press release announcing they are stomping out competition to create a monopoly, so they can jack up prices in the future? In the 2020’s, data will be the driving force of consolidation….and specifically, data as a competitive advantage. Cornering the market on data affects competition like Roundup affects weeds: it kills what’s there and prevents new growth.

Google will soon encrypt internet traffic to improve security. This will restrict who has access to browsing data, since many internet service providers (ISPs) don’t currently support the encryption.(25) By this point you sense the trend. Google says the new protocol will give consumers control over who gets their internet surfing data. You can read between the lines. The protocol allows the search giant to maintain their dominance over internet data. Google maintains their competitive advantage as they limit the amount of data others can access. Data as a competitive advantage. Google doesn’t get more data, but they nonetheless have a bigger share of the data pie as others’ access to data dwindles. Data as a zero “sum-ish” game. It’s all relative.

Firefox Mozilla, the other browser onboard with encryption, has said ISPs are raising antitrust concerns about Google not because there are antitrust concerns, but because they want to ensure continued data access. Did they just concede the point? 😂 The reason there is an antitrust concern is precisely because Google will have access to data that other internet browsers will not! Not only did they concede the point, they pin-pointed that exclusive access to data IS the antitrust concern. There are numerous ISPs, but now only two will have this browsing data (until the others support encryption).

The antitrust concern here isn’t about market share! It’s about access to data!

Data guarding to ensure data as a competitive advantage.

Gleanable nuance #7: Everyone is fighting the same fight. The race to corner a market on data, data wars, and data as a zero “sum-ish” game are happening everywhere. Look for them in self storage. What acquisitions have been motivated by the desire for access to, and control of, data? What acquisitions are next? What products or services are developed and offered simply to obtain data? What policies are aimed at data as a competitive advantage? Remember when we were all stoked on free apps until we realized it was a way to collect our data and sell it? What is the analogous situation in self storage today? What will it be tomorrow?

OMG. Where to begin with Facebook?! We could write a novel, but in short, the FTC is “seeking to determine if (acquisitions) were part of a campaign to snap up potential rivals to head off competitive threats.”(26) What’s ironic is that in 2013 Facebook acquired an entity “to identify and target fast-growing companies as potential purchases” and such data later led to the acquisition of WhatsApp.(27) Hmmm….purchasing companies for their data on which companies to buy for their data.

Final gleanable nuance #8: When in doubt, the answer is data. Was it “b” or “c” we all filled in when we didn’t know the answer on a scantron? Well, now when in doubt, just answer data.

Cliff Notes on Case Studies

What did we just learn about data as a competitive advantage? Consolidation is now about data. Data has the power to transform an industry. Apple and Google’s Alphabet (often neck and neck for the world’s greatest market capitalization) are making moves to limit others’ access to data. Companies targeted for data or data tools are often purchased at a crazy premium…indicating the value of data. Data plays are simultaneously offensive and defensive. Data is a zero “sum-ish” game.

Conclusion

We’ve made tremendous headway, but we haven’t connected all the dots yet. Stick with us.

The Problem

Not long ago, we were worrying about our Google rankings and SEO, and actually debating the pertinence of advertising in the Yellow Pages. 🙈

The landscape has undoubtedly changed, but maybe we can’t quite put our finger on the change or how to adapt. When in doubt, what’s the answer? That’s right, data.

Industry leaders now have web dominance + data. This data secures their web dominance and ensures that everything that happens before and after that internet search for “self storage” is maximizing profits. The gap will get bigger and bigger. Faster and faster. It’s self-perpetuating. Web dominance reinforces data dominance and data dominance reinforces web dominance.

How did they achieve this powerful combo? Consolidation for data. Consolidation to create layers of data that provide far better insights. Consolidation to connect different services that previously couldn’t work together because everyone was arguing over data and APIs, creating a significantly higher combined value because now the various services can work together. Consolidation to prevent others from consolidating for data.

Let’s review a few of the storage industry M&A.

Storage Consolidation

Landscape Today

We’ve established that data is a zero sum-ish game and it’s all about first to market. Consolidation of data lends itself to monopolies. Layered data. In other words, “‘competition in the market’…is replaced by ‘competition for the market,’ meaning that once a firm has won the battle to control a sector, it faces little challenge from other rivals.” In short, “technology leads to single-firm dominance and (does) so quickly.”(28)

Bigger gap. Faster. Independent operators simply cannot compete. Now, this does not mean they will be out of business, they might still make a great income. But they aren’t competing. It’s the Flintstones versus the Jetsons. It’s tee ball versus the major leagues. As Dane Elefante of Platinum Storage grimly puts it, “In exchange for leads, we became the tech companies’ suppliers of inventory and data, enabling their industry consolidation.” Kudos Dane.

The end result of industry consolidation? Likely squeezed margins and less choice. To be fair, this might not be that bad. You might want a storage industry behemoth to help you run your facilities better and with less headache. But don’t fool yourself, the behemoth will dictate products, prices and much more. You lose independence, control, autonomy, choices, self-determination. You’ll be at their mercy. Your success or failure won’t just depend on your good or bad choices, it will also depend on theirs. They might just straight up make a bad decision, or there could be conflicts of interest, or you might not be their top priority. There’s nothing wrong with taking the simple, easy route. Hitting a stationary ball off a stick could be fun as you’re rounding third base. But if you want to play in the major leagues, AND YOU CAN, then let’s put our big boy pants on.

The Solution

So how do we solve our industry behemoth problem?

If data consolidation will quickly lead to single-firm dominance, we need to restrict outflow of our data as a defensive move and band together to compete as an offensive move. Don’t feed the monster and compete with the monster. That’s nonsensical.

You want to maximize your benefit from your data and limit others’ benefit from your data when it could harm you. THEY NEED ALL OF YOUR DATA for their systems to work and deliver returns. So restrict their access to the DATA YOU NEED THEM TO HAVE. Don’t feed the monster if the monster could eat you.

Let’s get geeky specific for a minute. You need an operating system with open, unrestricted APIs. You need “PMS agnostic” tech – tech that works with any PMS. At the same time, you need intelligent controls to prevent unnecessary data outflows. Right now, when a vendor accesses your data for a specific task, you are probably giving them access to ALL of your data. The inefficiency of this is mind-boggling. And there’s a real dollar cost associated with that, such as increased hosting costs.

More importantly, you are feeding the monster. Why do all of these vendors need ALL the data from ALL their clients. They don’t, and it was actually just an unintended result of the piecemeal evolution of self storage tech. But now, everyone’s eyes are open to the value of data and these vendors can really do something with this data if they want. What vendors do with all that data might not be in your interest.

It might work directly against your interest. Or, if the past is any indication of the future, private equity will keep purchasing these vendors because they understand the value of the data and they know to make money from it.

Did you know even the REITs were giving away all their data until they figured out workarounds? Here’s where it gets exciting. REITs are far ahead of independent owners in the data race. But now, consolidated tech companies are far ahead of the REITs in the data race. REITs are limited to their own data sets while a vendor that has picked up pieces of the supply chain has access to different data sets they can layer for even better insights. It’s no longer the REIT advantage (access to all THEIR data & knowing how to use it) – it's the consolidator advantage (access to EVERYONE’S data to LAYER data & knowing how to use it). Is this our chance to leapfrog over the REITs? Have they gotten a little cocky and comfortable? Storable is going to catch them by surprise. Tenant and Storelocal can catch them by surprise. We have the technology to help you restrict the outflow of your data. Technology that bring true innovation to the industry and secures your place in it. Let’s not keep feeding the monster.

Speaking of….we hate to point out the holes in our own argument, but you might be wondering whether joining Tenant is tantamount to creating another monster. In order to compete with Storable and to restrict the outflow of your data, Tenant will gain access to data. Yes. #Truth. We want a path forward that safeguards individual owners and the industry as a whole. We are aiming for a foolproof solution. But a perfect solution might not be possible, and we can’t stop in the meantime. The fast eat the slow. Storable is already there, but we can get there, and we’re doing it with better products. With ground up innovation rather than painstaking integration of mediocre products. With more facilities behind us, we can be really fast and really smart. Help us help you. The time is right. You can benefit from industry tech without handing over everything you’ve worked so hard to build and protect.

The industry needs competition to avoid monopoly. If Storable is a behemoth, we suggest that a behemoth’s power and growth must be checked by another monster. More like a benevolent monster owned by independent operators and aligned with the interests of the vast majority of the industry. Picture the weird, furry, “ideas are scary” creature from the GE commercial (which is arguably the best commercial ever).(29)

A monster and a weird furry creature will not only keep each other from getting too big and scary, but they’ll also keep the path open for a third critter to join the fun. Then it gets easier for a fourth to join. Suddenly, there isn’t even a single monster anymore. The balance of power between owners and vendors is restored. We all live happily ever after in self storage utopia, and there aren’t any monsters hiding under the bed.

-----------

Footnotes

(1) Our prediction track record is so lengthy we had to relegate it to a footnote: REITs consolidated the industry; tech companies consolidated the industry; tech companies built a direct relationship to your customers, whereby owners are dependent on them in order to reach out and touch a customer; tech companies increased their pricing but also made it too cumbersome to leave to use a competing product or service; tech companies contracted away your ownership in your data and functionally gatekept the flow of your data; tech companies bundled services, to further entrench you and make it harder for you to leave; tech grew as a proportion of both your operational man hours and expenses. Just to name a few.

(2) As we will note shortly, and have consistently said, this truly comes down to personal preference. Some owners will gladly surrender autonomy for ease

of operations. Some owners will gladly accept lower margins for fewer headaches. Plus, the SpareFoot guys are good guys, we like and respect them (although they are now answerable to private equity). But none of that changes the fact that competition is necessary for the industry’s well-being.

(3) HBO’s Outsider is terrific by the way.

(4) This is admittedly imprecise. Applying the concept of a zero sum game to data in the storage industry however, is helpful to paint a picture. If you don’t utilize your data, and you give it to someone else that does, it's a zero sum situation. You lose, they gain. In the real world however, you do utilize your data (albeit incompletely and imperfectly) and you also gain from allowing others to access your data. Otherwise you wouldn’t give anyone access. We’re intentionally being a bit dramatic to make the point that there should always be a cost-benefit analysis when sharing your data. If there was a sliding scale of zero “sum-ness” (oxymoron, we know), then the more you benefit from your data and the more you guard against others using your data at your expense, the less zero “sum-esque” things become. This is our point: unless enough of us act, and quickly, Storable (and other consolidated entities) will have a ginormous competitive advantage that over time may become insurmountable.

(5)Just kidding. It’s not luck at all. It’s the result of a lot of brain power, painstaking effort, late nights, and financial investment.

(12) This may explain why SpareFoot opted for the clunky gobble and smash approach to consolidation rather than ground-up innovation. If we had been in their shoes, perhaps we also would have initially prioritized market share over product quality. This however, is a perfect illustration of the beauty of competition. Storable might be the first to market, but if a superior product gains traction, Storable will have to improve and/or cede market share.

(16) Did you know that Chuck Gordon started SpareFoot as a way to rent out a literal spare foot in one’s closet or garage….as an alternative to self storage? The man is adaptable. If the rest of us could have been a bit more adaptable, the industry wouldn’t have its own version of Amazon. It’s not too late, we can still change our mindset.

(29) You can watch this brilliant commercial here: https://vimeo.com/104651324 ... The visuals will tug at your heartstrings, but the messaging is equally as impressive: “Ideas are scary. They come into this world ugly and messy. Ideas are frightening because they threaten what is known. They are the natural born enemy of the way things are. Yes, ideas are scary. And messy. And fragile. But under the proper care, they become something beautiful.”